Xero payroll apps are revolutionizing how businesses manage their employee compensation. Are you tired of spending countless hours on manual payroll tasks , struggling to keep up with ever-changing tax laws , and worrying about costly errors? Xero payroll apps offer a streamlined , automated solution that simplifies payroll processing , ensures compliance , and saves you valuable time and resources. These apps integrate seamlessly with the Xero accounting platform , providing a thorough solution for managing employee compensation. This article will explore the key attributes , benefits , and optimal practices for using Xero payroll apps to maximize your payroll processes. We’ll cover everything from setting up your app to troubleshooting common issues and staying ahead of future trends. By the end of this article , you’ll have a clear understanding of how Xero payroll apps can transform your business and empower you to focus on growth and strategic initiatives. We will cover: Understanding Xero Payroll Apps , Setting Up Your Xero Payroll App , Advanced attributes and Customization , Troubleshooting Common Issues , and Future Trends in Xero Payroll Apps.

Understanding Xero Payroll Apps

Xero payroll apps are designed to integrate seamlessly with the Xero accounting platform , providing a thorough solution for managing employee compensation. These apps automate various payroll tasks , such as calculating wages , withholding taxes , and generating pay stubs. By leveraging the power of cloud technology , Xero payroll apps offer real-time access to payroll data , enhanced security , and improved collaboration among team members.

Key attributes of Xero Payroll Apps

Xero payroll apps come equipped with a scope of attributes designed to streamline payroll management. These include:

- Automated Payroll Calculations: Automatically calculate wages , taxes , and deductions based on employee data and applicable regulations.

- Tax Compliance: Ensure compliance with federal , state , and local tax laws by accurately withholding and remitting taxes.

- Employee Self-Service: Allow employees to access their pay stubs , W-2 forms , and other payroll information online.

- Direct Deposit: Facilitate direct deposit of employee paychecks into their bank accounts.

- Reporting and Analytics: Generate detailed reports on payroll expenses , tax liabilities , and other key metrics.

benefits of Using Xero Payroll Apps

Implementing Xero payroll apps can bring numerous benefits to businesses of all sizes. Some of the key benefits include:

- Time Savings: Automate repetitive tasks and reduce the time spent on payroll processing.

- Accuracy: Minimize errors and ensure accurate payroll calculations.

- Compliance: Stay up-to-date with changing tax laws and regulations.

- Cost Savings: Reduce the need for manual labor and paper-based processes.

- Improved Employee Satisfaction: offer employees with timely and accurate paychecks and easy access to their payroll information.

Choosing the Right Xero Payroll App

With a variety of Xero payroll apps available , it’s essential to select the one that optimal meets your specific business needs. Consider factors such as:

- Business Size: select an app that can handle the number of employees you have.

- Industry: select an app that is tailored to your industry’s specific payroll requirements.

- Budget: Find an app that fits your budget and offers the attributes you need.

- Integration: Ensure the app integrates seamlessly with your other business systems.

- Support: Look for an app that offers reliable customer support.

Case Study: Streamlining Payroll with Xero

Consider a small business that was struggling to manage payroll manually. The owner was spending hours each week calculating wages , withholding taxes , and generating pay stubs. This was taking away from valuable time that could be spent on growing the business. After implementing a Xero payroll app , the owner was able to automate these tasks , saving significant time and reducing the risk of errors. The app also offerd employees with online access to their pay stubs , which improved employee satisfaction. As a outcome , the business was able to focus on its core operations and achieve its growth objectives.

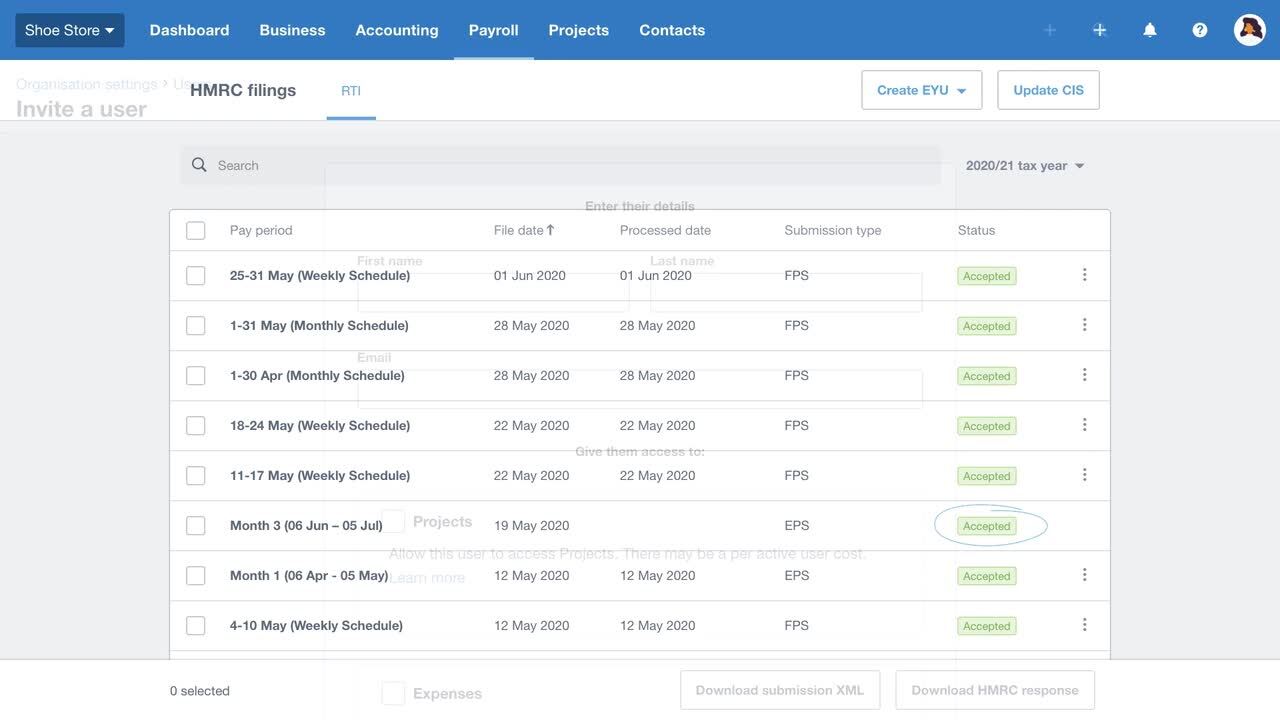

Setting Up Your Xero Payroll App

Setting up your Xero payroll app involves several key steps to ensure accurate and compliant payroll processing. This includes configuring your company settings , adding employee information , and setting up payroll schedules. A well-configured payroll app is crucial for smooth operations and accurate financial reporting.

Configuring Company Settings

The first step in setting up your Xero payroll app is to configure your company settings. This includes entering your company name , address , and tax identification number. You will also need to set up your payroll calendar , which determines how often you will pay your employees. Additionally , you may need to configure settings related to benefits , deductions , and other payroll-related items.

Adding Employee Information

Once you have configured your company settings , the next step is to add employee information. This includes each employee’s name , address , social security number , and other pertinent details. You will also need to enter each employee’s pay rate , withholding allowances , and any deductions or benefits they are entitled to. Accurate employee information is essential for accurate payroll calculations and tax reporting.

Setting Up Payroll Schedules

Setting up payroll schedules involves defining the frequency with which employees are paid access-based , such as weekly , bi-weekly , or monthly. You will also need to specify the pay period start and end dates , as well as the pay date. It’s crucial to align your payroll schedules with your company’s policies and applicable labor laws. Proper scheduling ensures timely and accurate payments to employees.

Integrating with Xero Accounting

One of the key benefits of using a Xero payroll app is its seamless integration with the Xero accounting platform. This integration allows you to automatically synchronize payroll data with your general ledger , eliminating the need for manual data entry. By integrating your payroll app with Xero , you can streamline your accounting processes and gain a more thorough view of your business finances.

Training Your Team

After setting up your Xero payroll app , it’s crucial to train your team on how to use it effectively. This includes training payroll administrators on how to process payroll , generate reports , and handle employee inquiries. It’s also crucial to train employees on how to access their pay stubs and other payroll information online. Proper training ensures that everyone is comfortable using the app and can perform their payroll-related tasks efficiently.

Case Study: Efficient Payroll Setup

Consider a growing company that recently implemented a Xero payroll app. The company’s HR manager spent several days configuring the app , adding employee information , and setting up payroll schedules. She also worked closely with the company’s accountant to ensure that the app was properly integrated with the Xero accounting platform. After the setup was complete , the HR manager trained the company’s payroll administrators on how to use the app. As a outcome , the company was able to streamline its payroll processes , reduce errors , and improve employee satisfaction.

Advanced attributes and Customization

Xero payroll apps offer a scope of advanced attributes and customization options to meet the unique needs of varied businesses. These include advanced reporting , custom pay items , and integration with other business systems. Leveraging these attributes can significantly enhance the efficiency and accuracy of your payroll processes.

Advanced Reporting

Advanced reporting attributes allow you to generate detailed reports on various facets of your payroll , such as payroll expenses , tax liabilities , and employee compensation. These reports can be customized to meet your specific needs and can be exported in various formats , such as Excel or PDF. Advanced reporting offers valuable insights into your payroll data , helping you make informed decisions about your business.

Custom Pay Items

Custom pay items allow you to create unique pay types to accommodate specific compensation arscopements , such as bonuses , commissions , or reimbursements. You can define the calculation method for each pay item and assign it to specific employees. Custom pay items offer flexibility in managing complex compensation structures and ensure accurate payroll calculations.

Integration with Other Business Systems

Xero payroll apps can integrate with other business systems , such as time tracking software , HR management systems , and accounting platforms. This integration allows you to automatically synchronize data between systems , eliminating the need for manual data entry. Integration with other business systems streamlines your workflows and improves the accuracy of your data.

Managing benefits and Deductions

Xero payroll apps offer tools for managing employee benefits and deductions , such as health insurance , retirement plans , and charitable contributions. You can set up benefit and deduction plans , enroll employees , and track contributions and deductions. Managing benefits and deductions accurately is essential for compliance with applicable laws and regulations.

Handling Complex Payroll Scenarios

Xero payroll apps can handle complex payroll scenarios , such as multi-state payroll , garnishments , and stock options. These apps offer tools for calculating taxes , withholding amounts , and reporting requirements for these scenarios. Handling complex payroll scenarios accurately requires expertise and attention to detail.

Case Study: Customizing Payroll for Unique Needs

Consider a company that needed to customize its payroll app to accommodate a unique compensation structure. The company’s employees received a base salary plus commissions based on their sales performance. The company used the Xero payroll app’s custom pay item attribute to create a commission pay item and define the calculation method. The company also integrated the payroll app with its sales tracking software to automatically calculate commissions. As a outcome , the company was able to accurately calculate and pay commissions to its employees , while also streamlining its payroll processes.

Troubleshooting Common Issues

Even with the optimal Xero payroll apps , you may encounter occasional issues. Common problems include incorrect tax calculations , employee data errors , and integration glitches. Knowing how to troubleshoot these issues can save time and prevent potential compliance problems.

Incorrect Tax Calculations

Incorrect tax calculations can occur due to errors in employee data , incorrect tax rates , or software glitches. To troubleshoot this issue , verify that all employee data is accurate and up-to-date. Also , check the tax rates and ensure they are correct for the applicable tax year. If the issue persists , contact Xero support or consult with a tax professional.

Employee Data Errors

Employee data errors can lead to incorrect payroll calculations and tax reporting. To prevent this , implement a process for verifying employee data when it is first entered into the system. Also , regularly review employee data to ensure it is accurate and up-to-date. Common employee data errors include incorrect names , addresses , and social security numbers.

Integration Glitches

Integration glitches can occur when there are issues with the connection between your Xero payroll app and other business systems. To troubleshoot this issue , check the integration settings and ensure that the connection is active. Also , check the logs for any error messages that may indicate the cause of the problem. If the issue persists , contact Xero support or the support team for the other business system.

Handling Employee Inquiries

Employees may have querys about their paychecks , tax forms , or other payroll-related matters. To handle these inquiries effectively , offer employees with access to their payroll information online. Also , train your payroll administrators to answer common employee querys. If an employee has a complex query , consult with a payroll expert or tax professional.

Ensuring Data Security

Data security is a critical concern when managing payroll information. To protect your data , use strong passwords , enable two-factor authentication , and regularly back up your data. Also , ensure that your Xero payroll app is compliant with applicable data privacy laws and regulations. Data breaches can have serious consequences , so it’s crucial to take data security seriously.

Case Study: Resolving Payroll Issues Efficiently

Consider a company that experienced an issue with its Xero payroll app. The company’s employees were not receiving their paychecks on time due to a glitch in the direct deposit system. The company’s payroll administrator contacted Xero support , who quickly identified and resolved the issue. As a outcome , the company was able to get its employees paid access-based on time and avoid any negative consequences.

Future Trends in Xero Payroll Apps

The landscape of Xero payroll apps is constantly evolving , with new attributes and technologies emerging all the time. Some of the key trends to watch include boostd automation , artificial intelligence , and mobile accessibility. Staying up-to-date with these trends can help you maximize your payroll processes and stay ahead of the competition.

boostd Automation

Automation is playing an increasingly crucial function in Xero payroll apps. Automation can streamline various payroll tasks , such as calculating wages , withholding taxes , and generating pay stubs. As automation technology improves , payroll processes will become even more efficient and accurate.

Artificial Intelligence

Artificial intelligence (AI) is also beginning to make its way into Xero payroll apps. AI can be used to automate tasks such as data entry , fraud detection , and compliance monitoring. AI can also offer insights into payroll data , helping you make better decisions about your business.

Mobile Accessibility

Mobile accessibility is becoming increasingly crucial for Xero payroll apps. Employees want to be able to access their pay stubs and other payroll information from their mobile devices. Payroll administrators also want to be able to manage payroll from their mobile devices. As mobile technology improves , Xero payroll apps will become even more mobile-friendly.

Enhanced Security

Security is a top priority for Xero payroll apps. As cyber threats become more sophisticated , payroll apps must implement enhanced security measures to protect sensitive data. These measures include encryption , two-factor authentication , and regular security audits. Enhanced security is essential for maintaining trust and compliance.

Integration with Other Business Systems

Integration with other business systems will continue to be a key trend for Xero payroll apps. Integration allows you to automatically synchronize data between systems , eliminating the need for manual data entry. Integration with other business systems streamlines your workflows and improves the accuracy of your data.

Case Study: Embracing Future Trends

Consider a company that is proactively embracing future trends in Xero payroll apps. The company is implementing AI-powered tools to automate data entry and fraud detection. The company is also providing its employees with mobile access to their payroll information. By embracing these trends , the company is positioning itself for achievement in the future.

In conclusion , Xero payroll apps offer a streamlined and efficient solution for managing employee compensation. By automating calculations , ensuring compliance , and providing detailed reporting , these apps empower businesses to focus on growth and strategic initiatives. Whether you’re a small startup or a large enterprise , integrating a Xero payroll app into your workflow can significantly improve accuracy , reduce errors , and save valuable time. Embrace the power of automation and take control of your payroll processes with Xero today! Consider exploring the various Xero payroll app options available to find the one that optimal suits your business needs and start experiencing the benefits of seamless payroll management.