The Credit Karma Debit Card App is revolutionizing how people manage their finances and build credit. Are you struggling to improve your credit score while managing your daily expenses? Many individuals find it challenging to balance spending and credit building , often leading to financial stress. The Credit Karma Debit Card App offers a unique solution by combining the convenience of a debit card with attributes designed to boost your creditworthiness. This article will explore the Credit Karma Debit Card App in detail , covering its key attributes , benefits , potential drawbacks , and how it compares to traditional debit cards. We’ll also address common concerns and misideaions , providing you with a thorough understanding of this innovative financial tool. Finally , we’ll discuss future trends and innovations in debit card apps , giving you a glimpse into what the future holds. Let’s dive in and discover how the Credit Karma Debit Card App can transform your financial life !

Understanding the Credit Karma Debit Card App

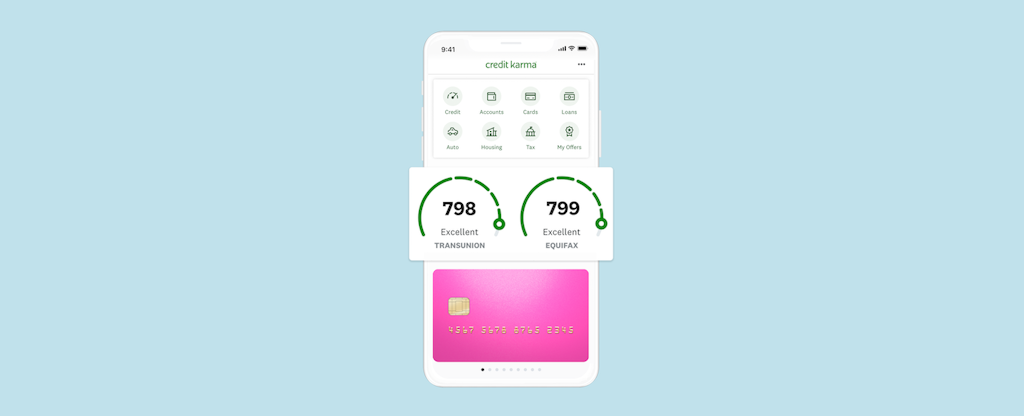

The Credit Karma Debit Card App is more than just a digital debit card ; it’s a thorough financial tool designed to help users manage their money and build credit simultaneously. Unlike traditional debit cards that primarily focus on spending , the Credit Karma Debit Card App integrates attributes that promote financial literacy and credit score improvement. This unique approach makes it an attractive option for individuals looking to enhance their financial health while managing their daily expenses.

Key attributes of the Credit Karma Debit Card App

The Credit Karma Debit Card App comes packed with attributes that cater to both spending and credit-building needs. Here’s a detailed look at some of its standout functionalities:

- Early Paycheck Access: One of the most appealing attributes is the ability to access your paycheck up to two days early. This can be a significant benefit for those living paycheck to paycheck , providing a cushion to avoid late fees or overdraft charges.

- Cashback Rewards: The app offers cashback rewards on select purchases , allowing users to earn money back on their everyday spending. While the cashback rates may vary , this attribute adds an extra incentive to use the card for daily transactions.

- Credit Score Monitoring: Credit Karma is well-known for its complimentary credit score monitoring service , and this attribute is seamlessly integrated into the debit card app. Users can track their credit score , view their credit report , and receive personalized recommendations for improving their creditworthiness.

- Spending Insights: The app offers detailed insights into your spending habits , categorizing transactions and highlighting areas where you can save money. This can be a valuable tool for budgeting and financial planning.

- FDIC Insurance: Funds held in the Credit Karma Debit Card App are FDIC-insured , providing peace of mind knowing that your money is protected up to the standard insurance amount.

How the Credit Karma Debit Card App Works

The Credit Karma Debit Card App operates similarly to other digital debit cards , but with a few key differences. Here’s a step-by-step overview of how it works:

1. Sign Up: Download the Credit Karma app and sign up for a complimentary account. If you’re already a Credit Karma user , you can simply log in to your existing account.

2. Apply for the Debit Card: Once you’re logged in , navigate to the debit card section and apply for the Credit Karma Debit Card. You’ll need to offer some personal information , such as your name , address , and Social Security number.

3. Fund Your Account: After your application is approved , you can fund your account by linking your existing bank account or setting up direct deposit. You can also deposit cash at participating retailers.

4. Start Spending: Once your account is funded , you can start using your virtual or physical debit card to make purchases online or in-store. You’ll earn cashback rewards on eligible purchases , and your spending will be tracked in the app.

5. Monitor Your Credit Score: Regularly check your credit score in the app to track your progress and determine areas for improvement. Credit Karma offers personalized recommendations to help you build credit , such as paying your bills on time and keeping your credit utilization low.

benefits of Using the Credit Karma Debit Card App

The Credit Karma Debit Card App offers a scope of benefits that make it an attractive option for individuals looking to improve their financial health. Here are some of the key benefits:

- Credit Building: The app’s primary focus is on helping users build credit , making it an ideal choice for those with limited or no credit history. By providing access to credit score monitoring and personalized recommendations , Credit Karma empowers users to take control of their creditworthiness.

- Financial Literacy: The app promotes financial literacy by providing insights into spending habits and offering educational resources on topics such as budgeting , saving , and investing. This can help users make more informed financial decisions and improve their overall financial well-being.

- Convenience: The Credit Karma Debit Card App offers the convenience of a digital debit card , allowing users to make purchases online or in-store without carrying cash. The app also offers attributes such as mobile check deposit and bill pay , making it easy to manage your finances on the go.

- Cost-Effective: The Credit Karma Debit Card App is complimentary to use , with no monthly fees or minimum balance requirements. This makes it an accessible option for individuals of all income levels.

Potential Drawbacks of the Credit Karma Debit Card App

While the Credit Karma Debit Card App offers many benefits , it’s crucial to be aware of its potential drawbacks. Here are some of the limitations to consider:

- Limited attributes: Compared to traditional debit cards , the Credit Karma Debit Card App may lack certain attributes such as overdraft protection or ATM access. This may be a drawback for users who rely on these attributes.

- Cashback Limitations: The cashback rewards offered by the app may be limited to select purchases or retailers. This may not be as appealing to users who prefer a more thorough cashback program.

- Reliance on Credit Karma: To use the Credit Karma Debit Card App , you must have a Credit Karma account. This means that your financial data will be shared with Credit Karma , which may be a concern for some users.

Is the Credit Karma Debit Card App Right for You?

The Credit Karma Debit Card App is a unique financial tool that offers a blend of spending and credit-building attributes. It’s an excellent option for individuals who are looking to improve their credit score , manage their spending , and gain financial literacy. However , it may not be the optimal choice for those who need advanced debit card attributes or prefer a more thorough cashback program. Ultimately , the decision of whether or not to use the Credit Karma Debit Card App depends on your individual financial needs and objectives.

Comparing the Credit Karma Debit Card App to Traditional Debit Cards

When evaluating the Credit Karma Debit Card App , it’s essential to compare it to traditional debit cards offered by banks and credit unions. While both types of cards allow you to spend money from your checking account , they differ in several key facets. Understanding these differences can help you determine which type of card is optimal suited for your financial needs.

Key Differences Between Credit Karma and Traditional Debit Cards

- Credit Building: The most significant difference between the Credit Karma Debit Card App and traditional debit cards is the focus on credit building. Traditional debit cards do not directly contribute to your credit score , as they are linked to your checking account and do not involve borrowing money. In contrast , the Credit Karma Debit Card App offers attributes such as credit score monitoring and personalized recommendations to help you improve your creditworthiness.

- Rewards Programs: Many traditional debit cards offer rewards programs , such as cashback or points , for using the card to make purchases. While the Credit Karma Debit Card App also offers cashback rewards , the selection of eligible purchases may be more limited compared to traditional debit cards.

- Fees: Traditional debit cards may come with various fees , such as monthly maintenance fees , overdraft fees , or ATM fees. The Credit Karma Debit Card App , on the other hand , is generally complimentary to use , with no monthly fees or minimum balance requirements. However , it’s essential to check the terms and conditions to ensure that there are no hidden fees.

- Overdraft Protection: Some traditional debit cards offer overdraft protection , which allows you to make purchases even if you don’t have sufficient funds in your account. This can be a convenient attribute , but it often comes with high fees. The Credit Karma Debit Card App does not offer overdraft protection , so you’ll need to ensure that you have enough money in your account before making a purchase.

- ATM Access: Traditional debit cards typically offer access to a network of ATMs , allowing you to withdraw cash when needed. The Credit Karma Debit Card App may not offer the same level of ATM access , which could be a drawback for users who frequently need to withdraw cash.

When to select a Traditional Debit Card

Traditional debit cards may be a better choice for individuals who:

- Prefer a wider scope of rewards programs: If you’re looking for a debit card that offers generous cashback or points on a variety of purchases , a traditional debit card may be a better option.

- Need overdraft protection: If you frequently overdraw your account , a traditional debit card with overdraft protection may offer a safety net , although it’s crucial to be aware of the associated fees.

- Require easy ATM access: If you frequently need to withdraw cash , a traditional debit card with access to a large ATM network may be more convenient.

- Value established banking relationships: If you prefer to bank with a traditional financial institution and value the personal service and security that it offers , a traditional debit card may be a better fit.

When to select the Credit Karma Debit Card App

The Credit Karma Debit Card App may be a better choice for individuals who:

- Want to build credit: If you have limited or no credit history and are looking for a way to build credit , the Credit Karma Debit Card App is an excellent option.

- Are financially disciplined: If you’re good at managing your money and don’t need overdraft protection , the Credit Karma Debit Card App can help you stay on track with your spending.

- Value convenience and cost-efficacy: The Credit Karma Debit Card App is complimentary to use and offers the convenience of a digital debit card , making it an attractive option for tech-savvy individuals.

- Are comfortable with online banking: If you’re comfortable managing your finances online and don’t need access to a physical bank branch , the Credit Karma Debit Card App can be a convenient and efficient way to manage your money.

Maximizing the benefits of the Credit Karma Debit Card App

To get the most out of the Credit Karma Debit Card App , it’s essential to use it strategically and take benefit of its various attributes. Here are some tips for maximizing the benefits of this innovative financial tool:

Tips for Effective Use

- Set Up Direct Deposit: To take full benefit of the early paycheck access attribute , set up direct deposit to your Credit Karma Debit Card App account. This will allow you to receive your paycheck up to two days early , giving you more flexibility and control over your finances.

- Use the Card for Everyday Purchases: To earn cashback rewards and track your spending , use the Credit Karma Debit Card App for all your everyday purchases. This will help you maximize your rewards and gain valuable insights into your spending habits.

- Monitor Your Credit Score Regularly: Check your credit score in the app regularly to track your progress and determine areas for improvement. Pay attention to the personalized recommendations offerd by Credit Karma and take steps to implement them.

- Pay Your Bills on Time: One of the most crucial factors in building credit is paying your bills on time. Use the Credit Karma Debit Card App to set up automatic bill payments and ensure that you never miss a due date.

- Keep Your Credit Utilization Low: Credit utilization , which is the amount of credit you’re using compared to your total available credit , is another crucial factor in building credit. Try to keep your credit utilization below 30% by paying off your balance in full each month.

- Take benefit of Spending Insights: Use the spending insights attribute to track your spending habits and determine areas where you can save money. Set a budget and use the app to monitor your progress.

- Explore Educational Resources: Credit Karma offers a variety of educational resources on topics such as budgeting , saving , and investing. Take benefit of these resources to improve your financial literacy and make more informed financial decisions.

Common Mistakes to Avoid

- Overspending: It’s easy to overspend when using a debit card , especially if you’re not tracking your spending carefully. Set a budget and use the Credit Karma Debit Card App to monitor your progress and avoid overspending.

- Ignoring Fees: While the Credit Karma Debit Card App is generally complimentary to use , it’s crucial to be aware of any potential fees , such as ATM fees or inactivity fees. Read the terms and conditions carefully to avoid surprises.

- Neglecting Credit Score Monitoring: One of the biggest benefits of the Credit Karma Debit Card App is its credit score monitoring attribute. Don’t neglect to check your credit score regularly and take steps to improve it.

- Relying on Overdraft Protection: The Credit Karma Debit Card App does not offer overdraft protection , so it’s crucial to ensure that you have enough money in your account before making a purchase. Overdrawing your account can outcome in fees and damage your credit score.

- Ignoring Security Alerts: Credit Karma may send you security alerts if it detects suspicious activity on your account. Pay attention to these alerts and take steps to protect your account from fraud.

Real-Life Examples

- Case Study 1: Sarah , a recent college graduate with no credit history , used the Credit Karma Debit Card App to build credit and manage her spending. By setting up direct deposit , using the card for everyday purchases , and paying her bills on time , Sarah was able to establish a positive credit history and qualify for a credit card within six months.

- Case Study 2: John , a complimentarylancer with inconsistent income , used the Credit Karma Debit Card App to track his spending and budget effectively. By using the spending insights attribute , John was able to determine areas where he could save money and improve his financial stability.

- Case Study 3: Maria , an immigrant with limited English proficiency , used the Credit Karma Debit Card App to access financial services and build credit. The app’s user-friendly interface and educational resources helped Maria navigate the complex world of personal finance and achieve her financial objectives.

Addressing Common Concerns and Misideaions

As with any financial product , the Credit Karma Debit Card App is subject to certain concerns and misideaions. Addressing these issues can help you make an informed decision about whether or not this app is right for you.

Common Concerns

- Security: One of the most common concerns about digital debit cards is security. Users may worry about the risk of fraud or identity theft. However , the Credit Karma Debit Card App employs industry-standard security measures to protect your account and personal information. Additionally , funds held in the app are FDIC-insured , providing peace of mind knowing that your money is protected.

- Privacy: Another concern is privacy. Users may be hesitant to share their financial data with Credit Karma. However , Credit Karma has a strong commitment to protecting your privacy and does not sell your personal information to third parties. You can also control the types of information that you share with Credit Karma.

- Fees: Some users may be concerned about hidden fees associated with the Credit Karma Debit Card App. However , the app is generally complimentary to use , with no monthly fees or minimum balance requirements. It’s crucial to read the terms and conditions carefully to ensure that there are no unexpected fees.

- Limited functionality: Compared to traditional debit cards , the Credit Karma Debit Card App may lack certain attributes such as overdraft protection or ATM access. This may be a concern for users who rely on these attributes. However , the app’s focus on credit building and financial literacy may outweigh these limitations for some users.

Common Misideaions

- The Credit Karma Debit Card App is a Credit Card: This is a common misideaion. The Credit Karma Debit Card App is a debit card , not a credit card. It is linked to your checking account and does not involve borrowing money. Using the app does not directly impact your credit score , but it can help you build credit by providing access to credit score monitoring and personalized recommendations.

- The Credit Karma Debit Card App is Only for People with Bad Credit: This is another misideaion. While the Credit Karma Debit Card App is an excellent option for people with bad credit , it can also be beneficial for people with good credit who want to manage their spending and track their credit score.

- The Credit Karma Debit Card App is Too Good to Be True: Some users may be skeptical of the Credit Karma Debit Card App , thinking that it’s too good to be true. However , the app is a legitimate financial tool that offers a scope of benefits. It’s crucial to do your study and read reviews from other users to make an informed decision.

Addressing Concerns and Misideaions

- Do Your study: Before signing up for the Credit Karma Debit Card App , do your study and read reviews from other users. This will help you understand the app’s attributes , benefits , and limitations.

- Read the Terms and Conditions: Read the terms and conditions carefully to understand the app’s fees , security measures , and privacy policies.

- Contact Customer Support: If you have any querys or concerns , contact Credit Karma’s customer support team for assistance.

- Start Small: If you’re hesitant to use the Credit Karma Debit Card App for all your spending , start small and gradually boost your application as you become more comfortable with the app.

Expert Opinions

- Financial Advisors: Financial advisors generally recommend the Credit Karma Debit Card App as a tool for building credit and managing spending. They emphasize the importance of using the app responsibly and avoiding overspending.

- Credit Experts: Credit experts praise the Credit Karma Debit Card App for its credit score monitoring and personalized recommendations. They advise users to pay their bills on time and keep their credit utilization low to maximize the benefits of the app.

- Tech Reviewers: Tech reviewers highlight the Credit Karma Debit Card App’s user-friendly interface and convenient attributes. They note that the app is a good option for tech-savvy individuals who want to manage their finances on the go.

Future Trends and Innovations in Debit Card Apps

The world of debit card apps is constantly evolving , with new attributes and innovations emerging all the time. As technology advances and consumer preferences change , we can expect to see even more exciting developments in the future. Here are some of the trends and innovations that are likely to shape the future of debit card apps:

Emerging Trends

- Integration with Cryptocurrency: As cryptocurrency becomes more mainstream , we can expect to see debit card apps that allow users to buy , sell , and spend cryptocurrencies. This will make it easier for people to use cryptocurrencies in their everyday lives.

- Personalized Rewards Programs: Debit card apps are likely to become more personalized , offering rewards programs that are tailored to individual spending habits. This will make rewards programs more pertinent and engaging for users.

- Enhanced Security attributes: As fraud and identity theft become more sophisticated , debit card apps will need to implement enhanced security attributes to protect users’ accounts. This may include biometric authentication , such as fingerprint scanning or facial recognition.

- Artificial Intelligence (AI) Integration: AI is likely to play a bigger function in debit card apps , providing personalized financial advice and helping users make smarter spending decisions. AI-powered chatbots can also offer instant customer support.

- Gamification: Gamification , which involves incorporating game-like elements into non-game contexts , is likely to become more popular in debit card apps. This can make managing your finances more fun and engaging.

Potential Innovations

- Real-Time Spending Alerts: Debit card apps could offer real-time spending alerts that notify users whenever they make a purchase. This can help users track their spending and prevent fraud.

- Automated Savings Tools: Debit card apps could offer automated savings tools that automatically transfer a portion of each purchase to a savings account. This can help users save money without even thinking about it.

- Financial Literacy Education: Debit card apps could offer financial literacy education to help users learn about budgeting , saving , and investing. This can empower users to make more informed financial decisions.

- Integration with Wearable Devices: Debit card apps could be integrated with wearable devices , such as smartwatches , allowing users to make purchases with a simple tap of their wrist.

- Virtual Reality (VR) Banking: In the future , we may see debit card apps that offer virtual reality banking experiences. This could allow users to manage their finances in a more immersive and engaging way.

Impact on Consumers

These trends and innovations are likely to have a significant impact on consumers. Debit card apps will become more convenient , personalized , and secure. They will also offer users with more tools and resources to manage their finances effectively.

Impact on the Financial Industry

The rise of debit card apps is also likely to have a significant impact on the financial industry. Traditional banks and credit unions will need to adapt to the changing landscape and offer rival debit card apps to attract and retain customers. Fintech companies are likely to continue to innovate and disrupt the industry with new and innovative debit card apps.

The Future is Bright

The future of debit card apps is bright. As technology advances and consumer preferences change , we can expect to see even more exciting developments in the years to come. Debit card apps will continue to evolve and become an essential tool for managing our finances in the digital age.

In conclusion , the Credit Karma Debit Card App offers a compelling suite of attributes designed to help users manage their finances effectively and improve their credit scores. By providing access to early paychecks , cashback rewards , and credit-building tools , Credit Karma aims to empower individuals to take control of their financial well-being. While it may not be a traditional debit card with all the bells and whistles , its unique focus on credit improvement sets it apart from the competition. If you’re looking for a debit card that can help you build credit while managing your everyday spending , the Credit Karma Debit Card App is definitely worth considering. Take the next step and explore how this innovative app can transform your financial future today !